6 Trends You May Have Missed About Earn Crypto Staking

Where Will Staking Crypto Be 1 Year From Now?

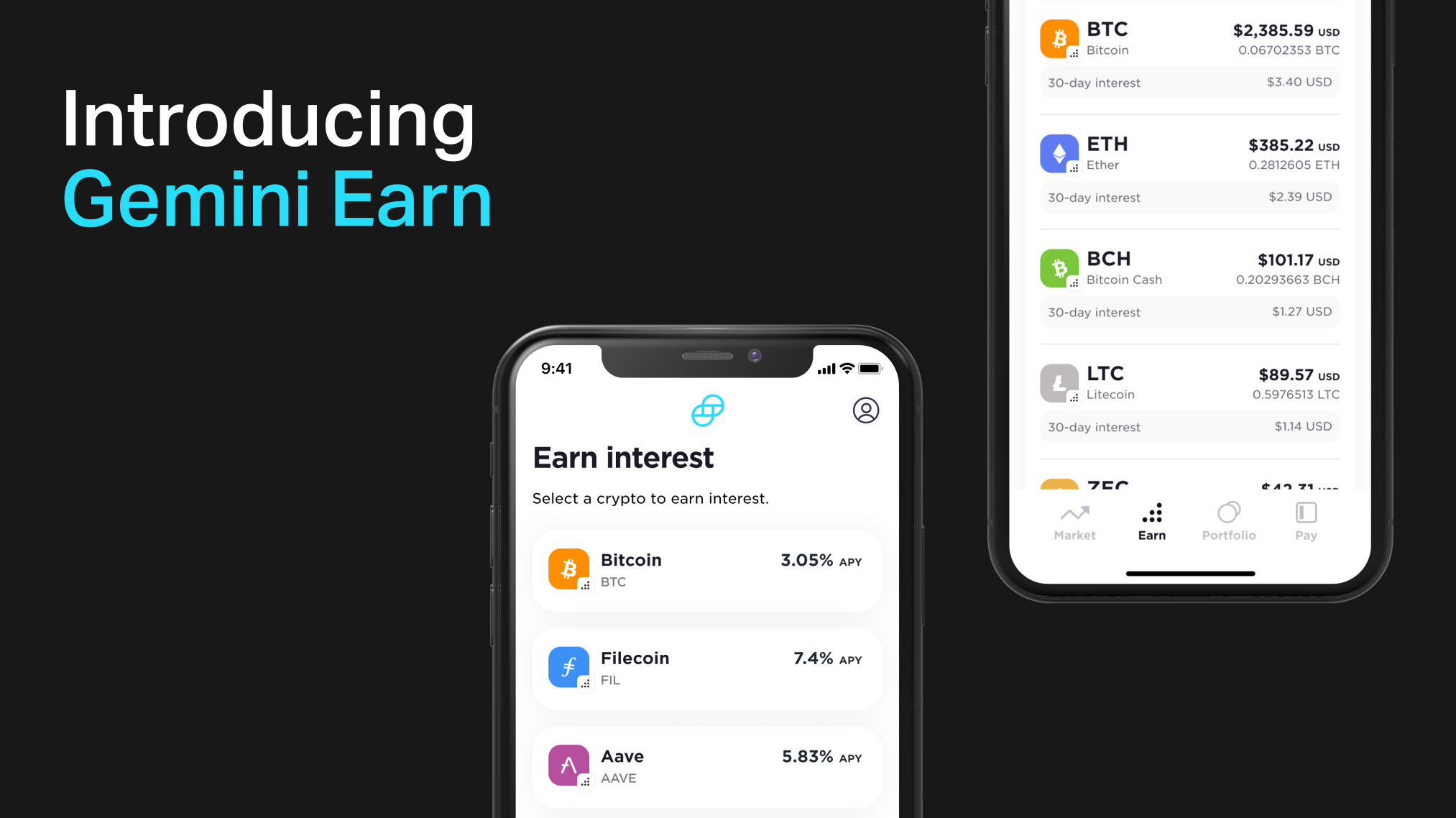

The spending info supplied on this web page is for academic objectives just. Geek, Pocketbook does not supply advisory or brokerage firm services, neither does it advise or recommend financiers to purchase or offer particular supplies, safeties or various other financial investments. Some cryptocurrency systems, such as Block, Fi and also Gemini, have actually begun to supply a method to make interest on crypto.

However like a lot of crypto tasks, there are big threats in shedding more cash than you make with these accounts. Here's a fast explainer on how crypto interest accounts function. What is a crypto rate of interest account? A crypto interest account is typically a crypto system's offering that lets you earn rate of interest on electronic properties that you've gotten.

7 things to recognize regarding crypto interest accounts1. Prices can be astronomically high, The crypto company Block, Fi, for example, uses prices from 0. Returns over time are difficult to compare, With traditional cost savings accounts, every little thing is in U.S. bucks so you can estimate the overall possible rate of interest you can earn in a year, thinking a rate doesn't alter.

Compare Best Crypto Interest Accounts - Up To 19%

Regulation of crypto interest accounts is underway, In September, Coinbase the greatest U.S. crypto exchange terminated its launch of a financing item that would gain interest for customers. This activity happened after Coinbase got notification that the united state Stocks and Exchange Compensation endangered to take legal action against, though the factor wasn't clear, Coinbase wrote in an article (proof of stake platform).

There's likely more regulation ahead, which can impact the use of these accounts. 6. Not all crypto firms operate in all states, Block, Fi's and also Crypto. com's systems, for example, aren't available to New Yorkers, though the accounts are options in the majority of states. 7. Crypto is except everyone, Greiser claims the individual that has the right threat cravings, time perspective as well as readiness to do their own due diligence and also study may think about crypto passion accounts.

If you're simply starting, consider these 3 questions before purchasing cryptocurrency. The writer possessed Bitcoin and also Ether at the time of publication. Geek, Budget is not suggesting or recommending visitors to acquire or offer Bitcoin or any various other cryptocurrency.

Aiming to increase your investment yield while messing around in the globe of cryptocurrency? A crypto interest-bearing account could be a way for you to substantially increase your rate of return. These accounts don't use the very same security that a financial institution or credit rating union interest-bearing account can use. Prior to you decide to spend, it is very important to comprehend just how crypto savings accounts work as well as their advantages and disadvantages.

How To Master Mycointainer Crypto In 30 Days

Hodlnaut, Hodlnaut has some of the highest possible payments to gain on your crypto. They only allow regular withdrawals to your purse, yet they have no lock in durations or minimum down payments.

And also, they are supplying a $20 bonus offer in cost-free bitcoin when you sign up as well as utilize this promo code: 126569833b. Gemini was late to the cryptocurrency financial savings video game.

Investors with smaller amounts of cryptocurrency are most likely to find far better yields beyond Crypto. com - earn crypto by staking. The platform pays passion on 15 typical cryptocurrencies and also 8 stablecoins. The yields are based on straightforward everyday rate of interest. As well as to get the highest possible yields you will certainly have to keep your investment for at the very least 3 months.

You, Hodler, You, Hodler's crypto-based financial savings accounts are high-yield and likewise seems to supply a lot of securities for financiers. earn money staking crypto. The business permits savers to take out from the platform at any time.

Earn - Learn how to Earn Interest on Crypto.

You can gain crypto with high APY by saving, betting, or taking benefit of promotional offers - staking crypto meaning. Ku, Coin Earn likewise has more properties offered to earn than many various other firms on this list.

1% APY on USDT and 0. 64% on BTC. They likewise have various other possessions that have much higher APYs.

Persons or persons located in the United States. Existing customers that are United state persons or located in the United States will be unable to transfer brand-new assets to their Predispositions.!? Here are a few points that set them apart.

Earn up to 10% APY - MyCointainer - BitCourier

You lose cash (or crypto) in this interest-bearing account. You need to believe of it extra as a financial investment instead than a cost savings account. Trick Accessibility, In a normal interest-bearing account, the cash is your own, complete stop. In crypto-based interest-bearing accounts, your crypto tricks are provided bent on other individuals that can use the crypto for a certain duration of time.

Yields, Yields on cryptocurrencies range from around 4% to 8% or more. This is significantly greater than the returns on traditional financial savings accounts. This is due to the fact that crypto financial institutions can not "produce cash supply," so they need to bring in capitalists with high yields. The supply and need for crypto financing drives the rate of interest.

Crypto cost savings accounts may impose much more restrictive restrictions on the regularity or quantity that you can withdraw. Sadly, there's no standardized guidance for withdrawal limits, so it is difficult to generalize on this factor. Substance Passion, One weird facet of particular crypto-based savings accounts is that passion might not compound.

You essentially have to invest or trade the interest to recognize the gains.: How Does Substance Passion Work?Crypto Financial Savings Accounts Vs. Crypto Budgets, Just how do crypto-based cost savings accounts compare with crypto purses!.?. Interest, When you have Bitcoin or another form of crypto in a budget, the number of coins you possess doesn't change over time. By comparison, crypto banks have built in redundancies to protect the crypto secrets.

The 5 Best Crypto Interest Accounts for 2022 - MyCointainer - BitCourier

In this manner, we can offer several of the most effective rate of interest for crypto, of approximately 12%APY for cryptocurrency deposits. Crypto Savings Accounts Vs. Self-Custody Crypto Purses, When it concerns keeping your cryptocurrency, you have an option in between putting it into a cryptocurrency interest-bearing account, or keeping it in a personal warm or cool crypto pocketbook. It is likewise a lower-risk investment when contrasted to other crypto investment alternatives, such as trading, and also uses all investors a simple way to use the cryptocurrency market growth as a way of diversifying your financial investment profile. What Does APY Mean in Crypto?. The distinction in between fiat APY as well as crypto APY is easy: the former handle passion paid in traditional cash while the latterin crypto. What regarding APR(Annual Percentage Price)? Unlike APY, which approximates the productivity of a financial investment over a year, APR addresses just how much it will certainly cost for a funding, covering the portion of the principal sum that you pay each year, taking monthly payments right into account. So as a debtor, it would certainly remain in your rate of interest to find the most affordable possible APR. They come down to the following: Realistic rate of interest used by the platform, The platform's plan as to making use of native tokens, Terms and also conditions of the account, What are Realistic Passion Rates? Marketed rates can seem as well good to be real, which is why you require to take a look at realistic rate of interest. g. tiered rates of interest based on the down payment quantity, approving rate of interest in, or holding a specific quantity of indigenous symbols ). Rates of interest for cryptocurrency interest-bearing account depend on the firm 's financial investment plan. We only offer to over-collateralised De, Fi systems that are wanting to meet the demand from traders. These systems need to have a substantial audit background to guarantee the safety and security of our clients'down payments. Instances of artificially generated price rallies or token failures as a result of sudden market swings have taken place in the past, so transforming your investment into such possessions is a risky effort. What Else Should I Know Prior To Picking a Financial Savings System? When choosing the most effective interest-bearing crypto account, you should likewise look right into the following locations: It may be easy to down payment but is it equally simple to take out? Sometimes, you can withdraw funds totally free as usually as you 'd like; in others, you have to pay a withdrawal charge every single time. Others may offer lower passion than promoted as a result of tiered rates based upon the size of your down payment. See to it you read the terms really carefully.: Expecting the service provider to pay you every week and discovering it really methods regular monthly payouts can be a substantial downer. See to it that you understand the payout regularity which it fits your specific needs. For capitalists preparing to gain rate of interest on Bitcoin or Ethereum, you will certainly find that the rates of interest below are significantly lower than in stablecoins. This is since Bitcoin or Ethereum loans are less preferred with institutional gamers, and their need straight affects the rates used by different platforms. If your holdings are generally in Bitcoin and also Ethereum as well as you're aiming to maximise your passion returns, a choice would certainly be to transform these right into stablecoins for a greater rate of interest on your properties. While flaunting relatively reduced threats, crypto cost savings accounts are still riskier than a bank's low-interest-rate cost savings account. Comprehending those risks is a requirement to beginning your own crypto savings account. Those dangers can be found in a number of groups: Insurance coverage, Challenging withdrawals, Market risks, Counter-party risks, Technological risks, Insurance, Unlike interest-bearing accounts at a financial institution, crypto interest-bearing accounts are exempt to compulsory insurance policy. Counterparty Risks, Counterparty dangers are additionally vital. The crypto interest-bearing account company finances your cash to a counterparty with high rate of interest, for this reason the rates of interest. Still, a service provider is not a financial institution, so a series of defaults may cause the whole scheme to collapse.

Comments

Post a Comment